When it comes to taking care of the finance related obligations, businesses prefer looking for a robust cloud accounting platform. While many CRM software are available in the market to execute this purpose, ZOHO Books from ZOHO Corp is simply incomparable.

Multiple tasks, one app!

ZOHO Books delivers a range of functions to keep your business updated on the financial front. Be it to abide by GST compliance, track stocks, carry out core accounting related tasks or any other job, this app never fails to amaze. No wonder, it can prove to be the most power packed accounting platform to ease out the financial tasks related to your business.

Fresh ZOHO Books Updates

Recently, ZOHO Books has introduced several fresh updates to ease out your accounting related hassles. Here is a quick insight into these new revelations:

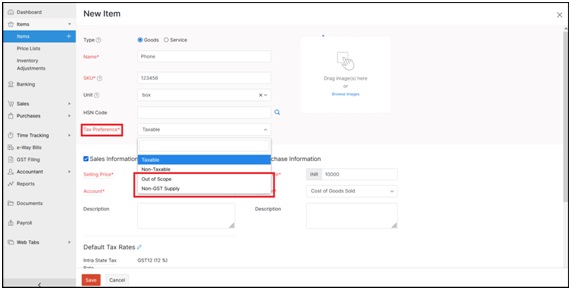

- New Tax Preferences

The developers of ZOHO Books have added new entry options against the Tax Preference field in the new Item form. These entries are Out of Scope & Non-GST Supply.

Here is the simple step to implement these new tax types to your items:

- Click Items Module

- On the top right side, Click + New button

- In the Tax Preferences field, select your tax type.

Once you apply the tax types to the item, they will get auto-populated when you create the transactions. They will also be instrumental in enabling you to import and export the items. Please be aware that this facility is available specifically in India.

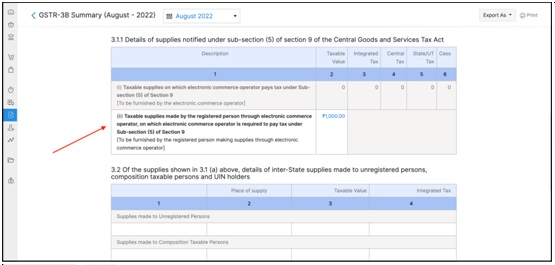

- New Table in GSTR-3B

The recently implemented CBIC amendment requires the electronic commerce operator (ECO) to pay tax on various services if supplied via ECOs. These include:

- Accommodation

- Restaurant services

- Passenger transport and

- Housekeeping

Evidently, ZOHO Books lets its users in India stay updated with this fresh amendment through the addition of Table 3.1.1(ii) in GSTR-3B. The facility allows the provision to report about the supplies but does not make it mandatory for the users to pay taxes for those services.

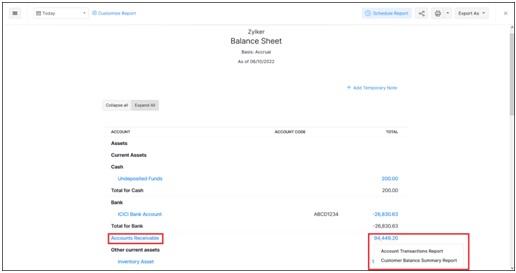

- View New Reports in your Balance Sheet

In the month of October itself, ZOHO Books has made a fresh modification in the Balance Sheet Report for its Indian users. Yes, we are talking about Accounts Receivable and Payable.

The app now allows you to check out the reports for account transactions and Customer Balance Summary. For this, you just need to click the Accounts Receivable link in the Balance sheet. Likewise, you can click Accounts Payable to get reports for Vendor Balance Summary and Account Transactions.

- Here is how you can view these reports

- In ZOHO Books, Navigate to the Reports module

- Look out for Business Overview

- Select the Balance Sheet

- Choose the duration for which you want the report

Claim VAT for an unpaid Invoice

This modification intends specifically to help the UK users. Consider an example where your customer is not able to pay for the goods or services that you sold to him. In any such event, it is now possible to write off the invoice in the category of Bad Debt.

Next, with the help of ZOHO Books you can claim the Value Added Tax (VAT) for this particular invoice around 6 months after the due date of invoice from the HMRC. This will lead to the creation of a journal entry followed by debiting of the claim amount from the Input VAT account and crediting of the same to the Bad Debt account.

Here are the steps to claim VAT for the written off invoice:

- Navigate to Sales à Invoices à Select Invoice

- Click Record Payment à Select Write Off

- Mention the Reason

- Check the box for Claim VAT for Writing off this invoice next to VAT Relief field.

- Mention the Claim Date and Claim Amount, respectively.

- Click the Write Off button in red at the bottom.

Let’s connect

To know more on the latest updates or to execute them at your end, you can always seek our help. As the ZOHO Premium Partner, we at CRM-Masters hold duly trained and experienced staff to adhere to your requirements related to ZOHO Books and other ZOHO Apps.

Image Sources: ZOHO.com