- November 18, 2025

- CRM-Masters

-

- 0

Client Profile

The client is a leading Health Insurance provider serving individuals, families, and corporate groups across India and the Middle East. They offer a wide range of health plans, including retail medical insurance, group policies for enterprises, top-up plans, critical illness coverage, and wellness benefits.

With a large network of agents, TPAs, hospitals, and corporate partners, the company handles high volumes of customer inquiries, policy renewals, claims, and documentation daily.

The insurance provider relied heavily on outdated systems, spreadsheets, and manual workflows to manage leads, policy onboarding, claim submissions, and customer support. These disconnected processes led to delays, lack of transparency, slow turnaround time, and inconsistent communication with customers.

India & Middle East

B2C & B2B (Group Insurance)

Finance & Insurance – Health Insurance

The client wanted to modernize and automate its entire health insurance lifecycle—from lead generation to claims management. The goal was to:

- Centralize all customer, policy, and claim information

- Automate lead distribution and agent follow-ups

- Streamline policy issuance and documentation

- Improve customer communication through automated updates

- Enhance claim processing speed and accuracy

- Provide a transparency-driven experience for customers and corporate partners

- Unified CRM for agent management, customer onboarding, and policy renewals

- Automated policy purchase workflow with document verification

- Claims management system with approval hierarchy

- Integration with TPAs and hospital billing workflows

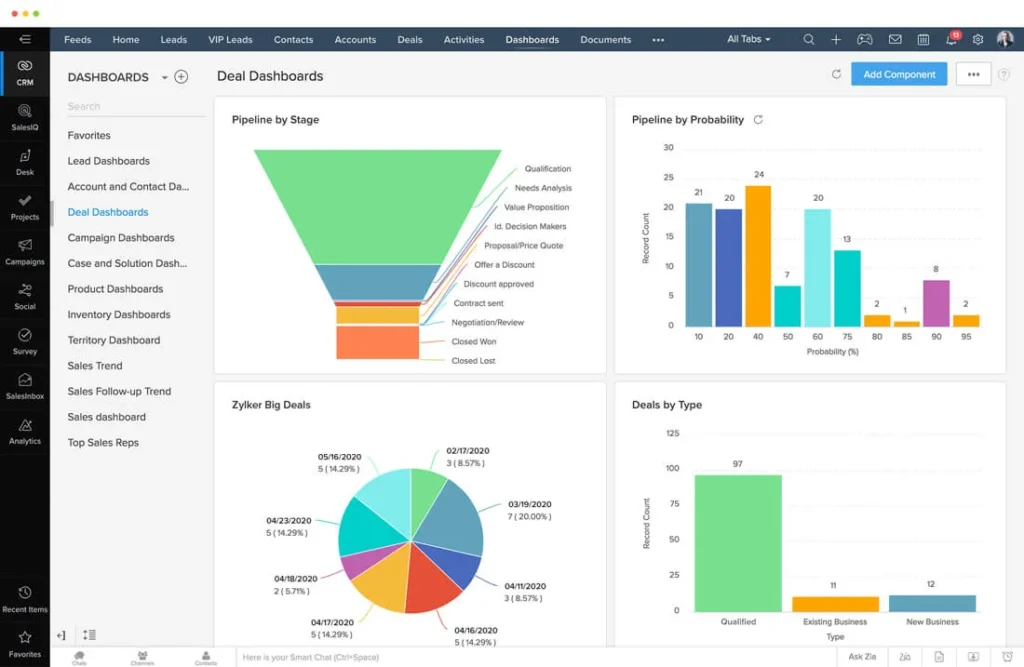

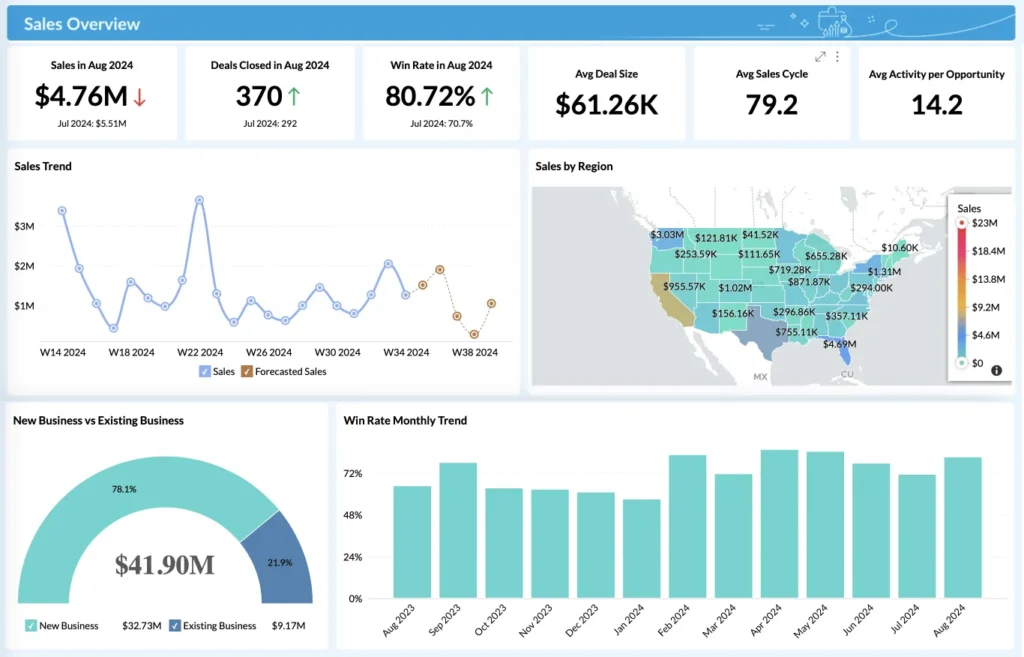

- Real-time dashboards for underwriting, claims, and sales

- Secure, role-based data access compliant with IRDAI regulations

Challenges Faced by Health Insurance Providers

High Lead Leakage & Delayed Responses

Leads coming from agents, website forms, aggregator portals, and campaigns were not captured centrally, causing delays and missed sales opportunities.

Complex Policy Issuance Process

Policy onboarding required multiple steps—document collection, verification, medicals, premium payment, and approval. Handling this manually led to errors and delays.

Slow Claims Processing

Claims involved multiple stakeholders including hospitals, TPAs, underwriters, and customers. Manual case tracking caused delays, errors, and unsatisfactory customer experiences.

Scattered Documentation

Critical documents (KYC, medical records, claim forms, discharge summaries, policy endorsements) were stored in different folders, making retrieval slow and audit compliance difficult.

Low Renewal Visibility

Agents lacked structured reminders for renewals, resulting in low retention and revenue leakage.

Limited Insights on Business Performance

The management team lacked real-time data on claim volumes, sales agent performance, or premium trends.

Our Solution for the Health Insurance Provider

Zoho CRM served as the centralized hub for lead capture, policy onboarding, agent performance tracking, and renewal reminders. Automated workflows distributed leads instantly to the right agent based on region, plan type, and lead source.

CRM pipelines provided complete visibility into proposal stages, pending documents, and approval status.

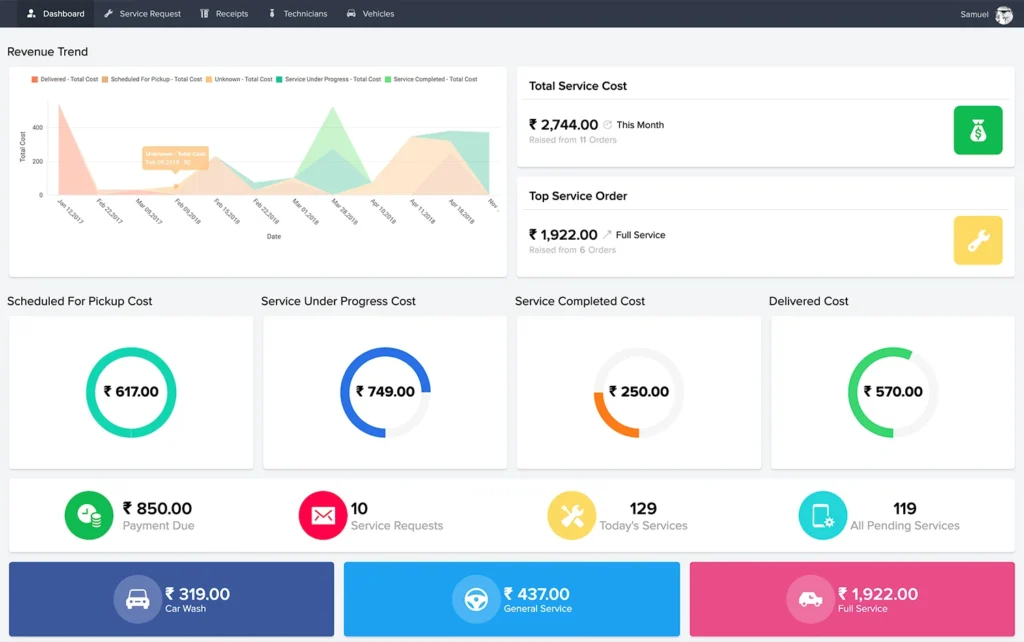

A custom application was built to digitalize:

- Policy purchase workflow

- Document submission and verification

- Claims logging

- Hospital and TPA coordination

- Underwriting approval process

- Real-time claim progress tracking

This eliminated manual paperwork and ensured faster claim resolution.

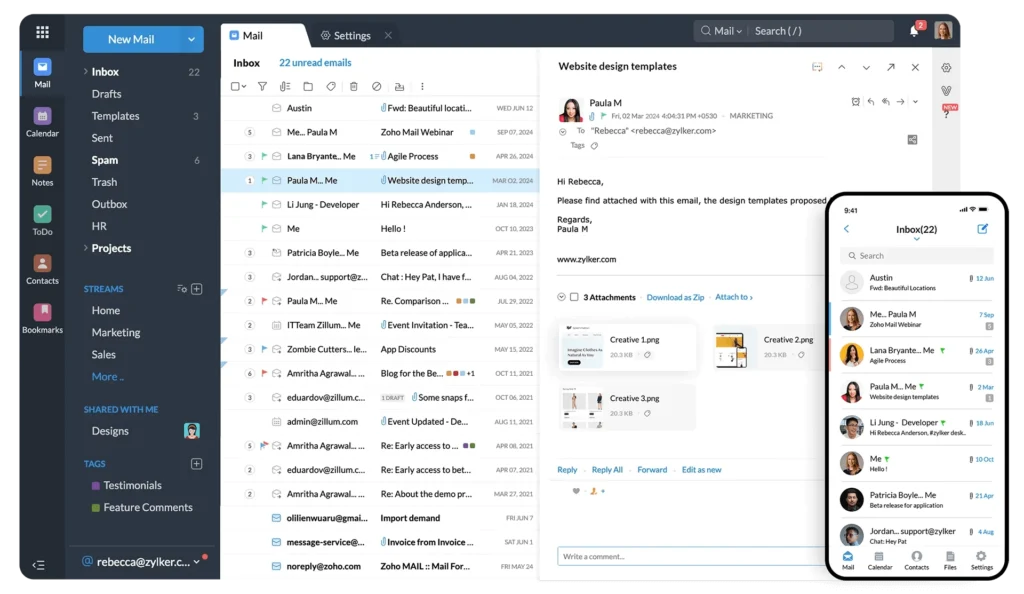

Zoho Desk centralized all customer support interactions. Emails, calls, chat, and WhatsApp queries were assigned automatically to support agents. SLA-based ticketing improved response time and customer satisfaction.

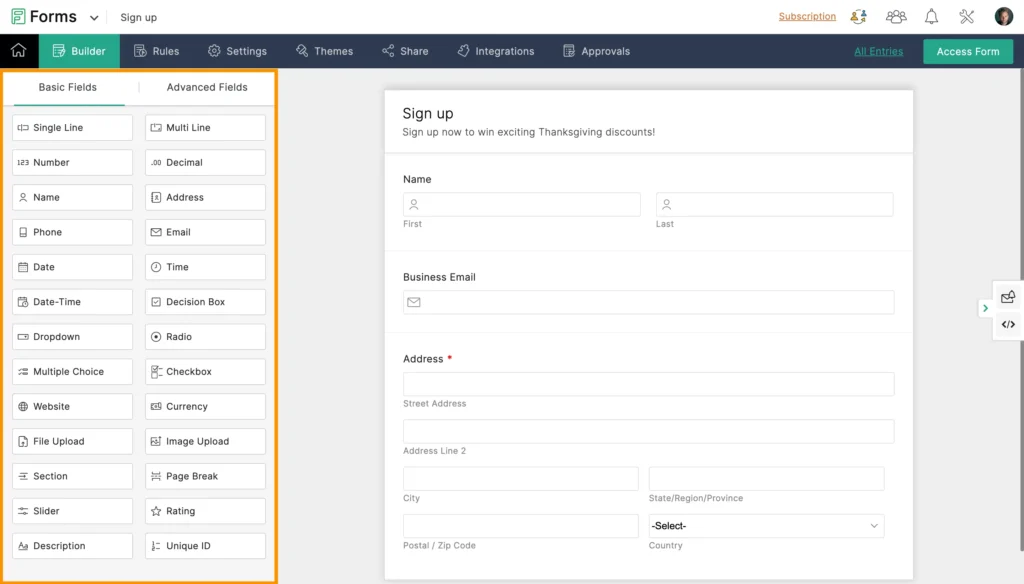

Digital forms were implemented for:

- Policy proposal forms

- Medical declaration forms

- Reimbursement claim submissions

- Hospitalization intimation forms

Forms synced instantly with the CRM and Claims App, reducing errors and lost documentation.

All policy documents, medical records, invoices, and claim files were stored securely with folder-level permissions, making audits and compliance effortless.

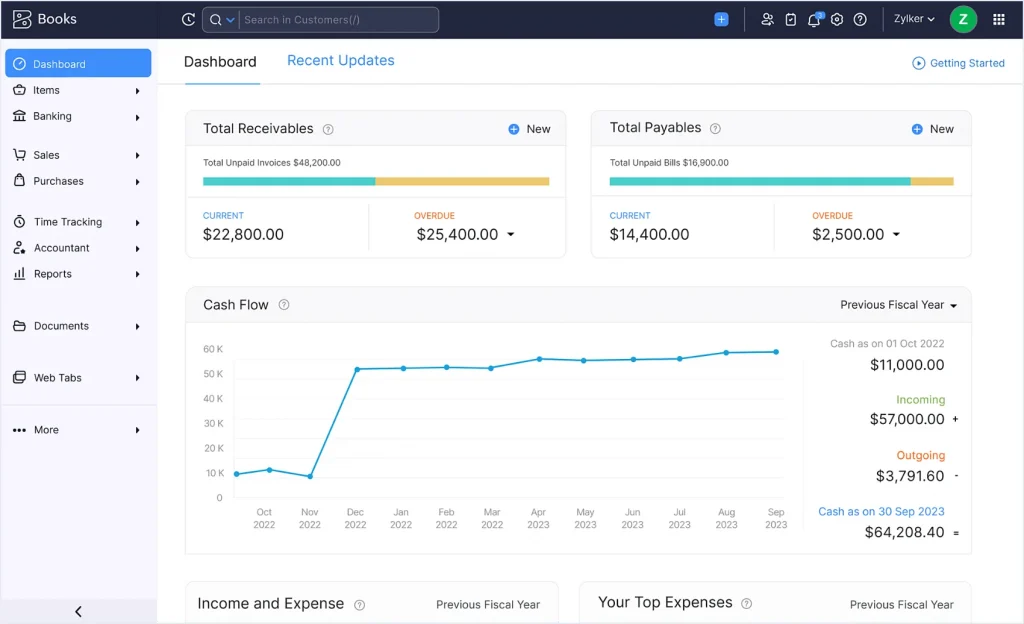

Premium invoicing, payment tracking, TDS, and commissions for agents were automated using Zoho Books. Integration ensured accurate financial reporting and faster reconciliation.

Advanced dashboards provided insights into:

- Claim settlement ratios

- Pending approval cases

- Renewal performance

- Agent-wise policy conversion

- TPA/hospital performance metrics

- Premium trends and profitability

Results Achieved with Zoho

Key Outcomes Included

Improved Sales Conversion

Faster lead routing and automated follow-ups improved closure rates and minimized lead leakage.

Faster Policy Issuance

Digitized workflows reduced onboarding time from days to hours, enhancing customer experience.

Efficient Claims Management

End-to-end claims automation improved accuracy and reduced processing time significantly.

Better Compliance & Audit Readiness

Centralized document management ensured compliance with IRDAI, internal audits, and underwriting standards.

Increased Customer Satisfaction

Automated updates, transparent claim tracking, and faster responses improved overall experience for both retail and corporate customers.

Performance Improvements

Faster Policy Issuance

Reduction in Lead Leakage

Faster Claims Processing Time

Accuracy in Document Management

Increase in Renewal Rates

Improvement in Agent Productivity

About CRM Masters Infotech

(ISO: 9001-2015 & ISO 27001:2022) Certified Company.

As a Zoho Premium Partner, CRM Masters Infotech specializes in implementing custom digital solutions for the BFSI sector, including health insurance, life insurance, financial advisory, and brokerage firms.

With over 10 years of experience and 4000+ successful Zoho implementations, we help insurance providers transform their sales, claims, service, and customer engagement processes using scalable Zoho applications.

Looking for Zoho implementation?

Talk to our experts today—trusted by businesses across the global.