- September 4, 2025

- CRM-Masters

-

- 0

Client Profile

Our client is a mid-sized capital funding company based in the United Kingdom, providing customized business loans, venture funding, and investment management solutions. With a growing client base of startups and established enterprises, the company needed to modernize its operations to improve efficiency, compliance, and client engagement.

Before implementing Zoho, the client relied on manual processes and disconnected systems. Loan applications were tracked using spreadsheets, customer communication happened over multiple channels, and reporting required significant manual effort.

London, United Kingdom

Capital Funding

As the capital funding company scaled its operations and client base, the inefficiencies of manual, spreadsheet-driven processes became increasingly problematic. Without a centralized CRM or integrated digital platform, they faced challenges in managing client data, tracking loan applications, ensuring compliance, and providing leadership with real-time visibility into their portfolio. These limitations slowed loan approvals, increased regulatory risks, and hampered client communication.

To overcome these challenges, the client partnered with our team to implement a comprehensive Zoho product designed specifically for the capital funding industry.

Challenges Faced by Our Client

The client was experiencing several operational roadblocks that were slowing down growth and creating risks in their business processes

Manual Loan Processing in Capital Funding

Every loan application required multiple manual steps for review and approval. This not only delayed the funding process but also reduced the company’s ability to handle higher application volumes efficiently.

Data Fragmentation Across Spreadsheets

Information about clients, loan applications, and financial records was scattered across spreadsheets, emails, and different software. This made it difficult to access accurate data quickly and created duplication of work across teams.

Compliance Risks in Financial Services

Since documentation and compliance tracking were done manually, there was always a risk of missing critical regulatory requirements. Any oversight could result in penalties or delays in operations.

Lack of Real-Time Insights

Leadership had no real-time reporting system to monitor loan pipelines, approval timelines, or portfolio health. Generating reports required manual effort, which delayed strategic decision-making.

Client Communication Gaps in Lending

With no automated reminders or structured communication workflows, follow-ups with clients were inconsistent. This sometimes led to missed opportunities and a poor client experience.

Solution Proposed

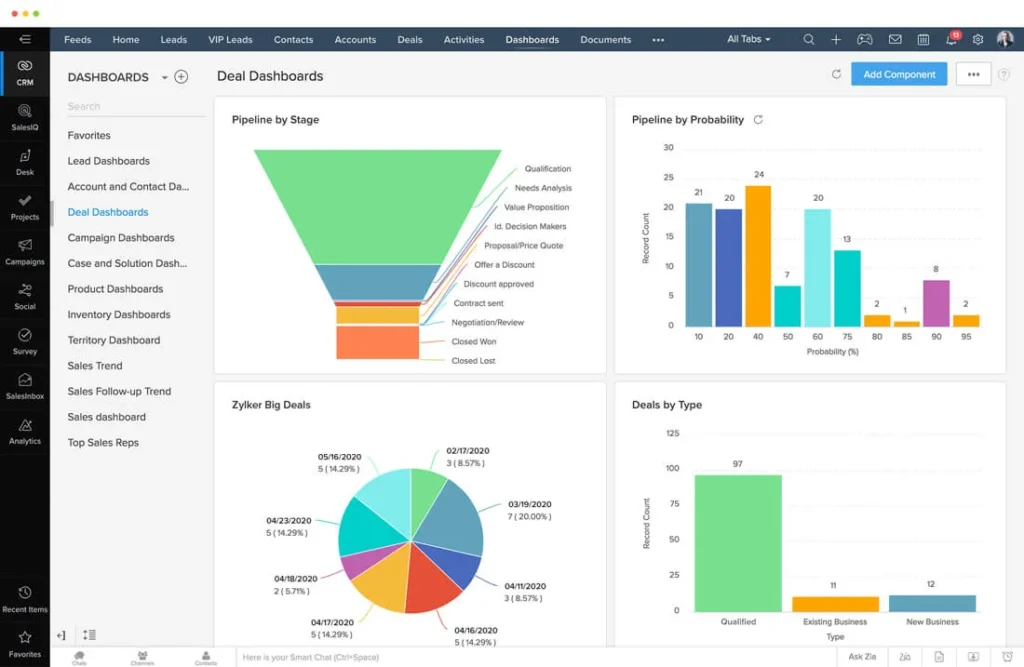

We implemented Zoho CRM as the central hub for managing the complete client lifecycle. From lead capture and deal tracking to loan applications and renewals, all customer interactions were consolidated into one platform. This gave the client a 360° view of their customers and streamlined relationship management across departments.

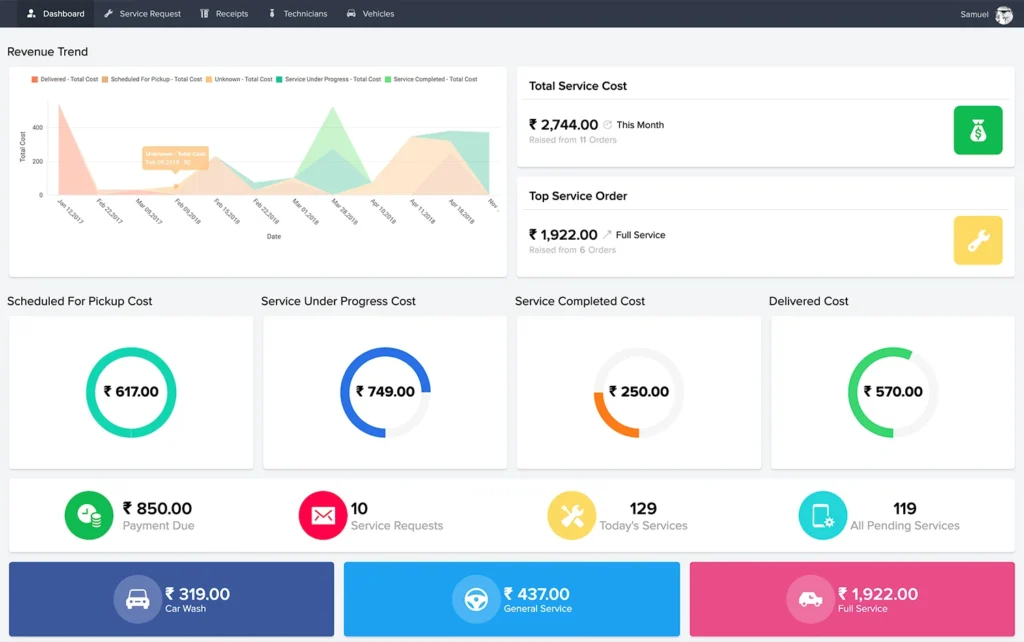

To eliminate delays in loan processing, our team built custom applications in Zoho Creator. We automated approval workflows, compliance verification, and risk assessment steps, which previously relied on manual effort. This significantly reduced processing time while ensuring regulatory compliance was always met.

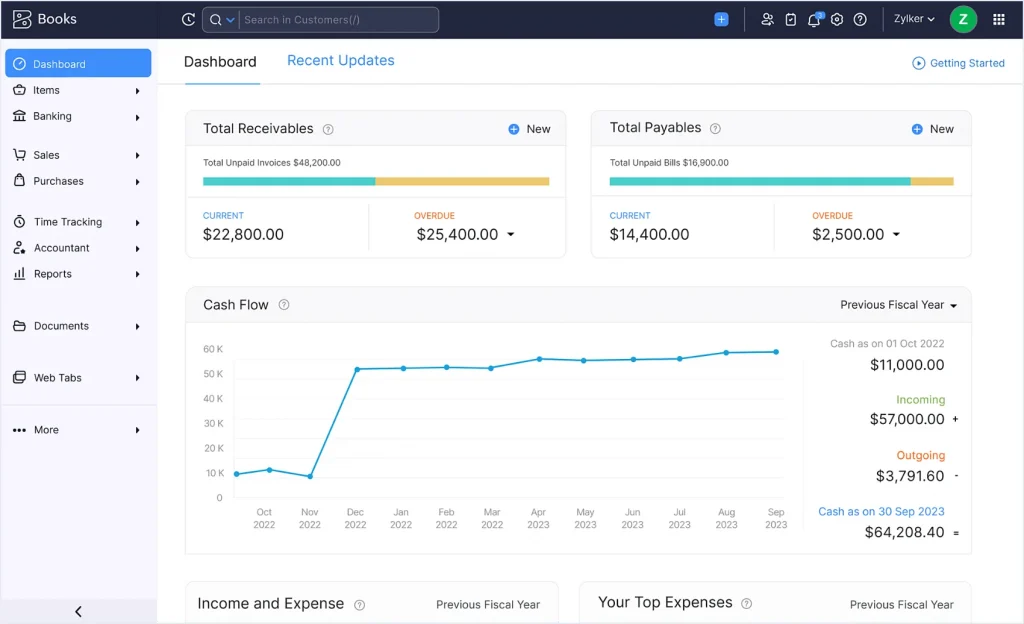

We integrated Zoho Books with CRM to unify financial operations. Loan disbursements, repayments, and invoices were linked directly with client records. The finance team could now track every transaction in real-time, reducing errors and saving time on reconciliation.

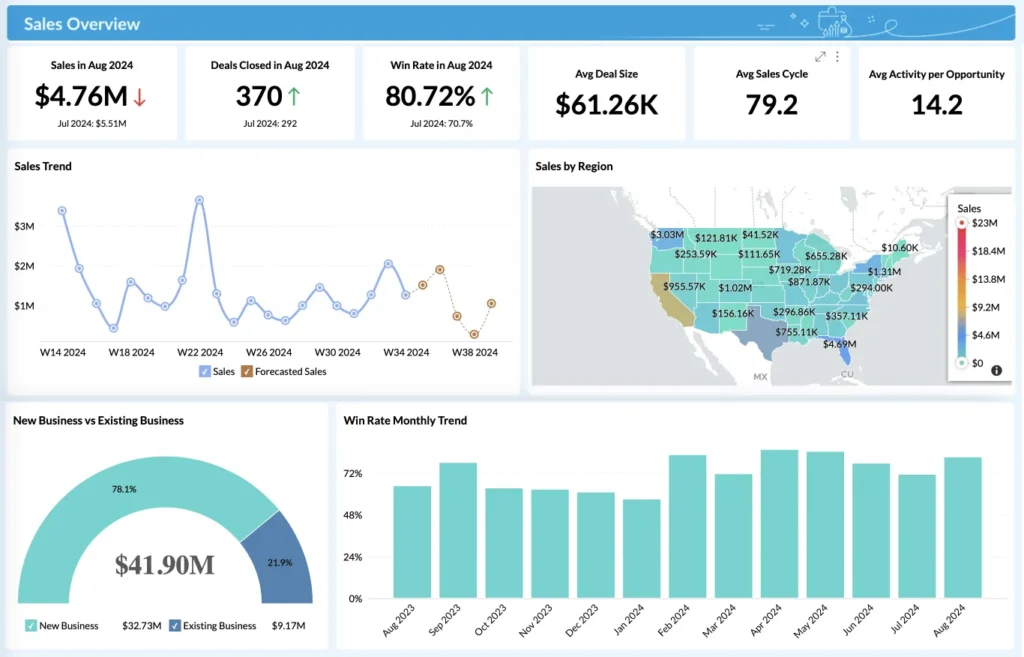

Our team built dashboards to monitor KPIs such as loan approval rates, portfolio performance, repayment cycles, and client acquisition. With real-time reporting, decision-makers could forecast demand and allocate resources effectively.

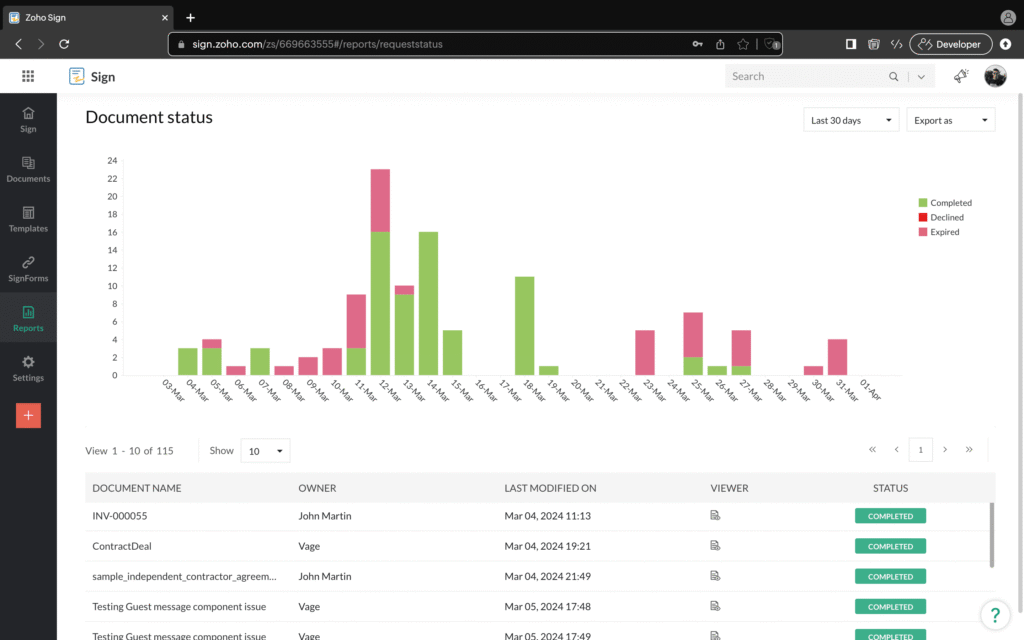

Documentation was a major pain point for the client, so we implemented Zoho Sign for secure digital signatures. Agreements and contracts could now be signed electronically, reducing turnaround times, strengthening compliance, and improving the overall client onboarding experience.

Zoho Consulting for Capital Funding Firms in the UK

From New York to Los Angeles, CRM Masters empowers Capital Funding with Zoho CRM, Zoho Creator, and Zoho Books—tailored to your workflows.

Results

Key Outcomes Included

- 40% faster loan approvals with automated workflows

- Centralized client data with a single source of truth across all departments

- Reduced compliance risks with automated documentation tracking

- Enhanced decision-making with real-time dashboards and analytics

- Improved client satisfaction with faster processing and consistent communication

Performance Improvements

faster loan approvals with automated workflows

Reduced compliance risks with automated documentation tracking

Enhancement in decision-making with real-time dashboards and analytics

Improvement in client satisfaction

This case study on CRM solutions for funding companies demonstrates how Zoho can transform financial services operations, making them more compliant, scalable, and client-friendly.

About CRM Masters Infotech

(ISO: 9001-2015 & ISO 27001:2022) Certified Company.

We are a CRM consulting company with over 9 years of experience and more than 2,050 successful projects. We have a proven track record of helping businesses optimize their workflows and boost growth. Our team of 100+ expert developers specializes in delivering top-notch eCommerce platforms, CRM, ERP integrations, and tailored business solutions to meet our clients needs.

Looking for Zoho implementation in the USA?

Talk to our experts today—trusted by businesses from California to New York.

Frequently Asked Questions (FAQ's)

Yes. Zoho CRM, along with Zoho Creator and Zoho Books, can be customized for loan application tracking, compliance management, repayment schedules, and customer communication, making it ideal for capital funding companies.

Zoho Creator enables automation of approval workflows, compliance verification, and risk assessments. This reduces manual errors, speeds up loan approvals, and ensures regulatory compliance.

Zoho Books helps manage disbursements, repayments, and invoices directly linked with CRM records. This ensures real-time financial tracking and reduces reconciliation errors.

Most companies start seeing measurable results within 3–6 months, including faster loan processing, improved compliance, and better client satisfaction.

With 9+ years of expertise and 2,050+ projects delivered, CRM Masters specializes in Zoho CRM for financial services. Our team ensures smooth implementation, customization, and ongoing support tailored to industry needs.